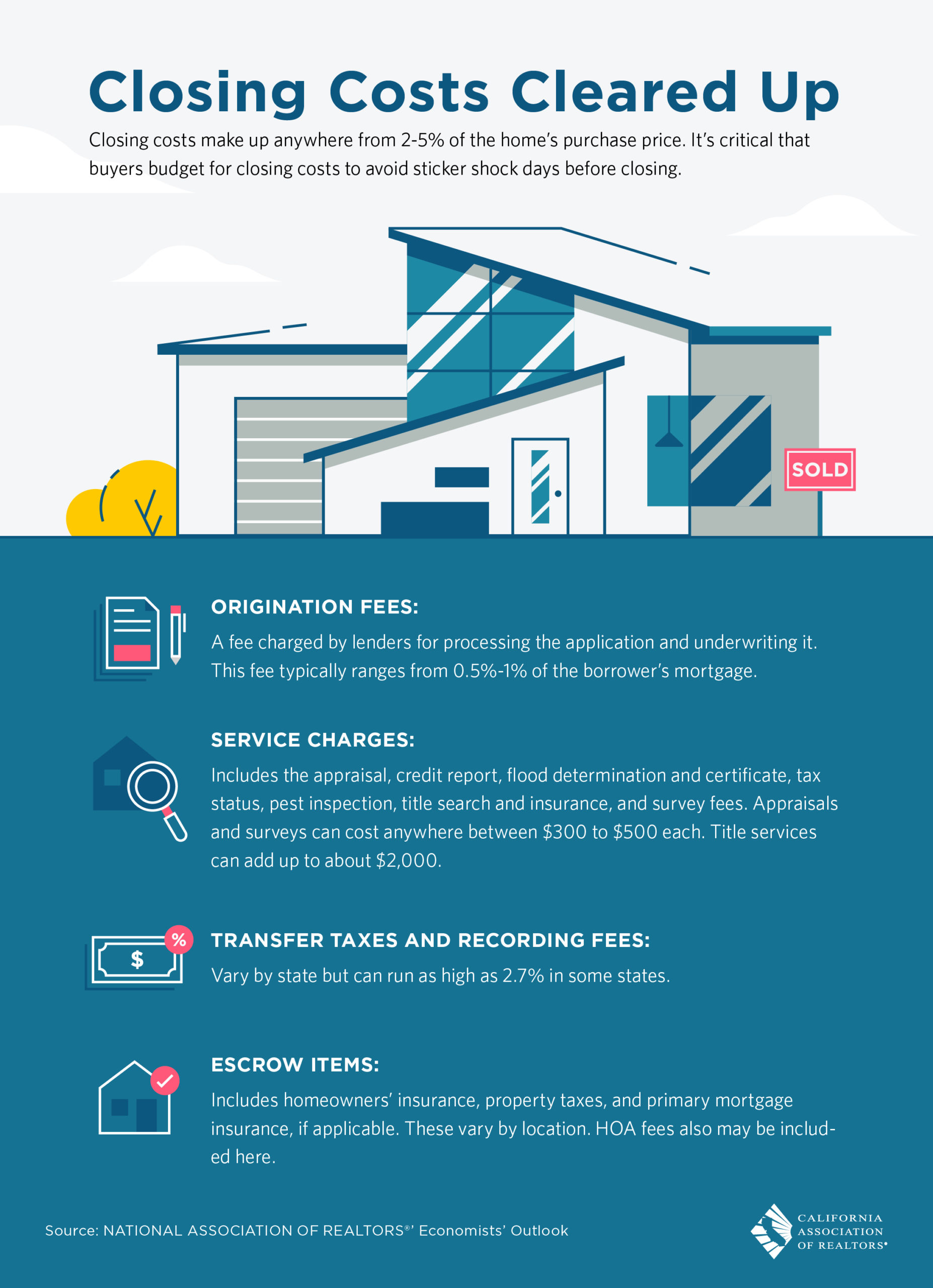

Closing costs make up anywhere from 2-5% of the home’s purchase price. It’s crucial that buyers budget for closing costs to avoid sticker shock days before closing.

ORIGINATION FEES:

A fee charged by lenders for processing the application and underwriting it. This fee typically ranges from 0.5%-1% of the borrower’s mortgage.

SERVICE CHARGES:

Includes the appraisal, credit report, flood determination and certificate, tax status, pest inspection, title search and insurance, and survey fees. Appraisals and surveys can cost anywhere between $300 to $500 each. Title services can add up to about $2,000.

TRANSFER TAXES AND RECORDING FEES:

Vary by state but can run as high as 2.7% in some states.

ESCROW ITEMS:

Includes homeowners’ insurance, property taxes, and primary mortgage insurance, if applicable. These vary by location. HOA fees also may be included here.